The post Five years on from Brexit, UK Automotive remains £115bn trading powerhouse appeared first on SMMT.

]]>

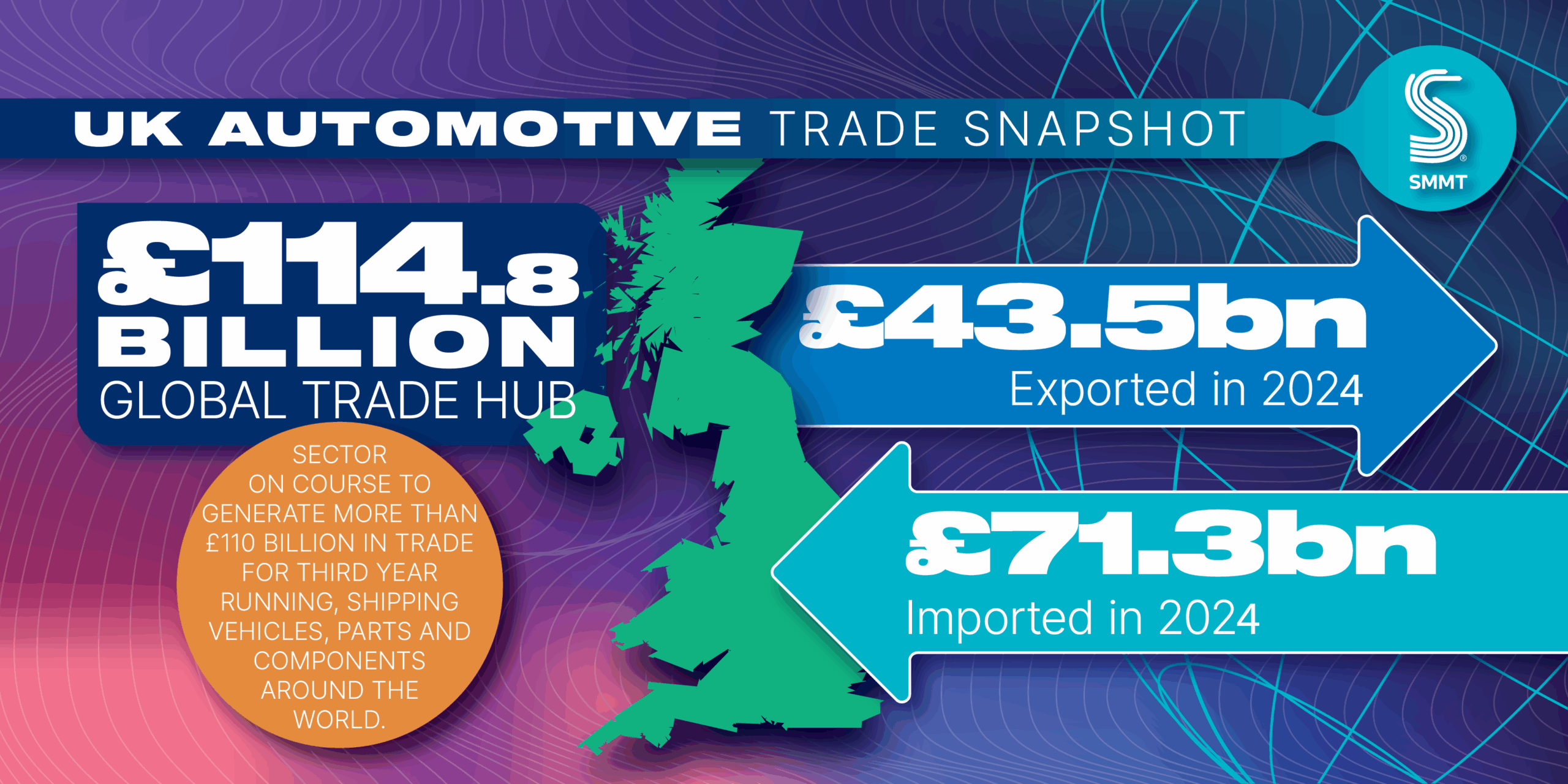

Five years on from Brexit, SMMT’s latest Trade Report, Unmarked Routes: Britain’s Pathway to Stronger Automotive Trade, sets out how the UK sector remains a global trading powerhouse, generating £115 billion in imports and exports last year. The sector is on course to generate more than £110 billion in trade for the third year running, shipping vehicles, parts and components around the world, in the face of incredibly tough conditions with tariff barriers, rising protectionism, and geopolitical uncertainty.1

While Brexit can be viewed as one challenge among many, leaving the EU has fundamentally altered trade conditions between the UK, the EU and other major trading partners. The industry has had to absorb significant costs from new customs and border requirements, while facing additional regulatory and tariff barriers and trying to secure billions to invest in electrification and other new technologies. Despite the EU-UK Trade and Cooperation Agreement (TCA) being signed almost five years ago, uncertainty still remains, with lack of clarity on trade definitions for key battery components and tougher rules of origin for electric vehicles due to kick in in less than 16 months’ time.

While many factors have affected global trade performance since Brexit, bilateral UK-EU automotive trade has underperformed compared with the UK’s trade with the rest of the world. This has been most visible in a slowdown in both export and import values with the bloc. Given the export focus of the sector, growing trade with all export markets is important but, with more than half of UK car exports heading into the EU and the vast majority of cars bought in Britain coming from Europe, the importance of cross-Channel trade is stark.

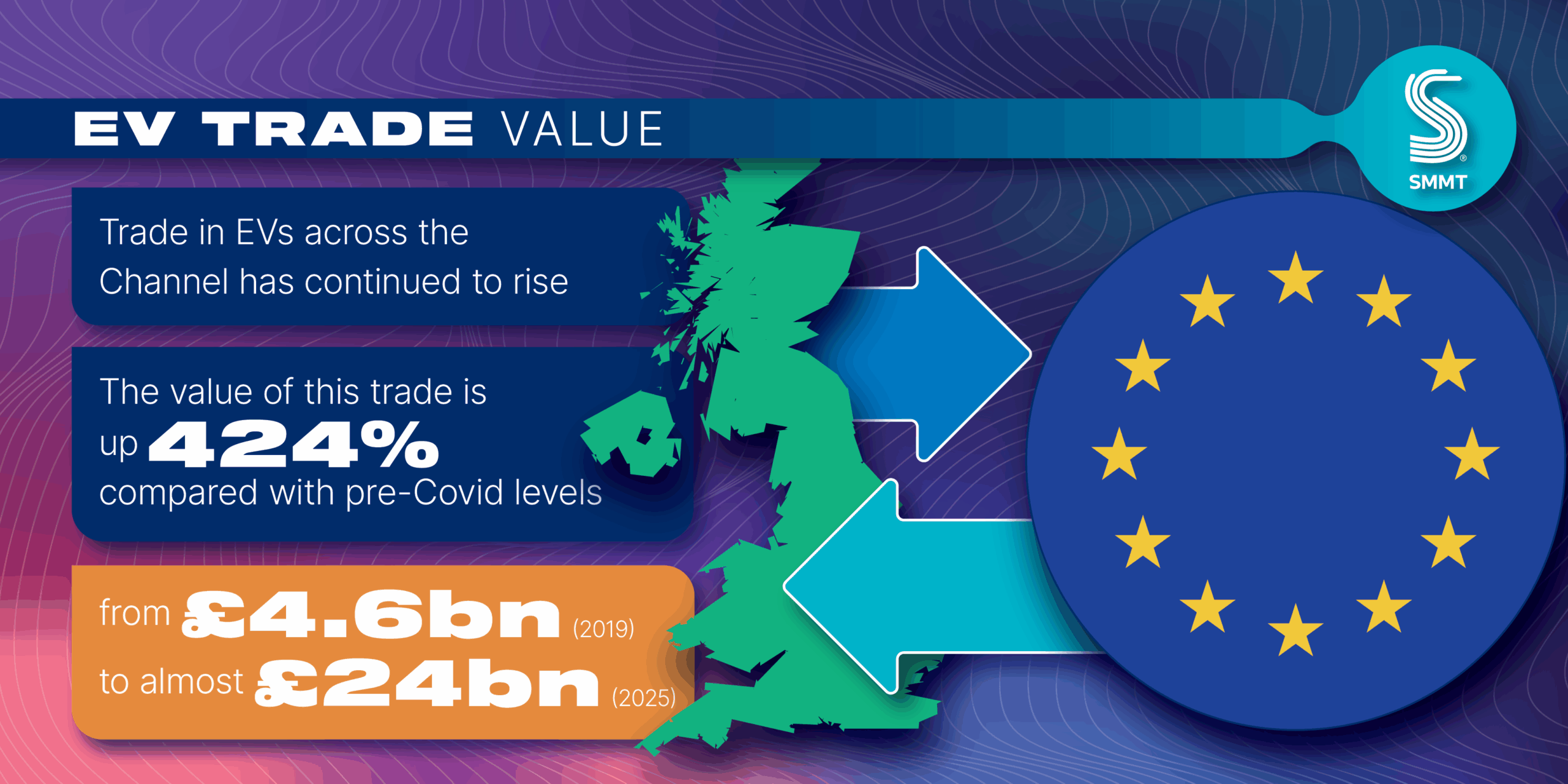

The UK and EU sectors remain inextricably linked, despite Brexit delivering a seismic change in trading conditions. £68.4 billion in annual automotive trade was generated between the two markets last year, representing by far the bulk (59.7%) of all UK Automotive trade value. A closer relationship would help safeguard this critical business – business that is increasingly driven by electrified vehicles (EVs) – with battery electric, plug-in hybrid and hybrid models now the largest proportion of cross border automotive trade.

Thanks to massive investment by manufacturers based in the UK and EU to deliver ever greater EV model choice covering every segment and price point, and growing demand, trade in EVs across the Channel has continued to rise. The value of this trade is up 424% compared with pre-Covid levels, from £4.6 billion in 2019 to almost £24 billion in the 12 months to June 2025.

The value of UK battery electric, plug-in hybrid and hybrid electric vehicle exports to the EU, meanwhile, has consistently outpaced pure internal combustion engine (ICE) shipments, and is today worth double. EU manufacturers, meanwhile, shipped EVs worth £17.6 billion to the UK in the last 12 months up to June 2025, with pure electric shipments outpacing those from China more than two-fold, and overtaking the value of ICE exports for the first time.

This growth is at risk, however, from a lack of clarity around tougher rules of origin requirements – agreed as part of the UK-EU TCA – for batteries and battery parts due from January 2027. These rules are currently unclear regarding how cathode active materials (CAM), an essential component in battery production, are defined, and they also set thresholds for local production in the UK or EU that are extremely challenging. Despite massive investments into the battery supply chain – notably in Somerset and Sunderland in the UK and at various locations across Europe – supply has not kept pace with demand.

Unless localised battery production increases considerably in the next 16 months – an impractical expectation given investment and construction timescales – electrified cars, buses and commercial vehicles that do not meet these new thresholds will be subject to tariffs ranging between 10% and 22% when traded across the Channel. With combustion models facing 0% tariffs, such a situation would make electrified vehicles uncompetitive in each market at a time when regulations stipulate manufacturers sell ever more zero emission models.

Industry is therefore calling on government to monitor expected compliance rates with 2027 EV rules of origin and engage immediately with the EU to agree on a workable cathode active material (CAM) definition. In parallel, the industry calls on government to consult with businesses and fast-track negotiations with the EU and other parties to re-join the Pan-Euro Mediterranean (PEM) Convention on rules of origin. While not a panacea, doing so would help strengthen UK-EU auto trade, enhance market access in trade with 14 other PEM participants and offer a flexible alternative to address this challenge if offered in parallel to TCA origin rules.

Despite the most difficult environment in decades, UK Automotive remains a powerhouse of global trade. With its unmatched diversity and world-class capability, the sector already trades across the world. But the global trading environment is getting tougher; more competition, more protectionism and more geopolitical tension. Forging closer trading relationships, notably with the EU, and implementing industrial and trade strategies with automotive at their heart will enable us to grow our economy, create thousands of highly skilled jobs, and lead the charge toward net zero.”

Unmarked Routes: Britain’s Pathway to Stronger Automotive Trade details a number of recommendations for the British government to ensure the UK continues to be a powerhouse of global automotive trade, including:

EV trade with Europe

- Provide an unwavering commitment to avoid tariffs on EU-UK EV trade

- Monitor compliance rates with 2027 EU-UK EV rules of origin

- Agree to a workable definition of origin rules for cathode active materials

- Fast-track negotiations to re-join PEM

Global relationships

- Finalise trade negotiations with South Korea and avoid the risk of tariffs from January 2026

- Fix the bilateral trade relationship with Canada with negotiations on an enhanced bilateral FTA while reinstating EU cumulation clauses and origin quotas in the meantime

- Secure an enhanced EU-UK regulatory partnership

- Maintain a balanced, fair and equitable trade relationship with China

- Seek progressive improvements on the Economic Prosperity Deal

- Ensure a swift implementation of the UK-India FTA

- Seek further tariff reductions with new and existing FTA partners

Regulation, investment and engagement

- Deliver an investment and industrial strategy to support UK vehicle production growth

- Step up engagement on automotive regulatory barriers

- Develop an effective single trade window together with business

- Relaunch a credible export promotion programme for the UK

- Rethink the UK business engagement model

Notes to editors

1: On course to generate more than £100 bn in 2025, £115 bn in 2024 and £120 bn in 2023

The post Five years on from Brexit, UK Automotive remains £115bn trading powerhouse appeared first on SMMT.

]]>The post Car production recovery continues in July appeared first on SMMT.

]]>File download

UK New Vehicle Manufacturing July 2025

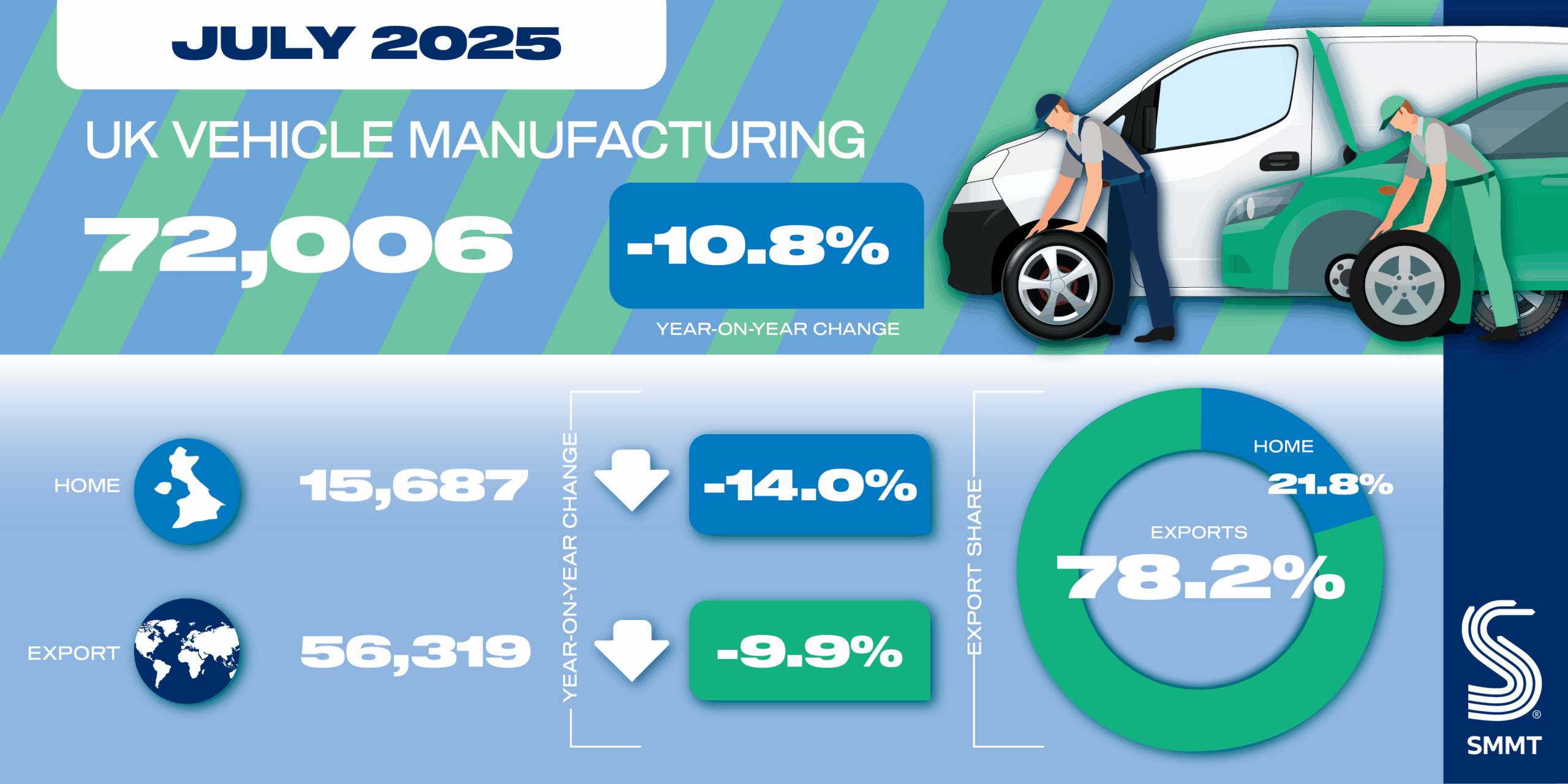

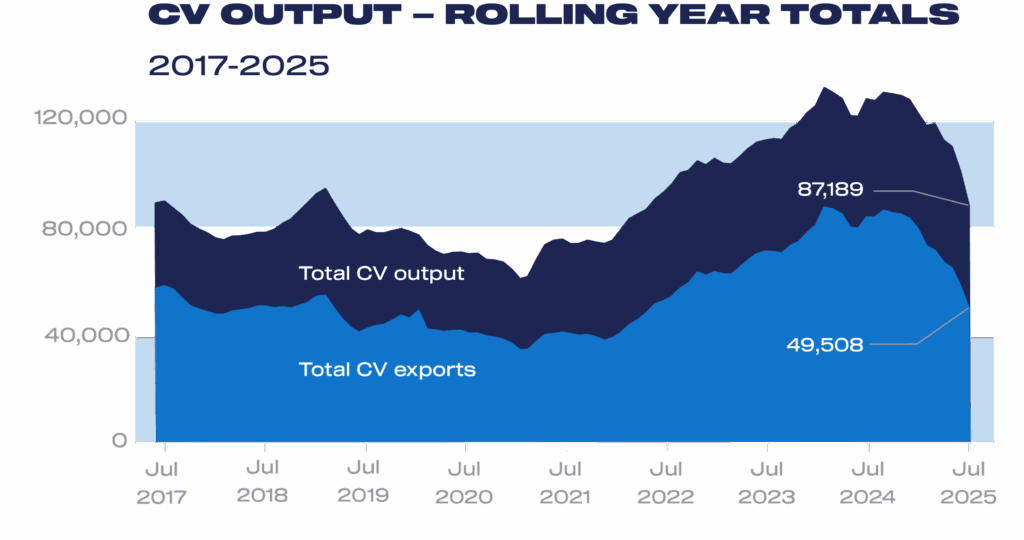

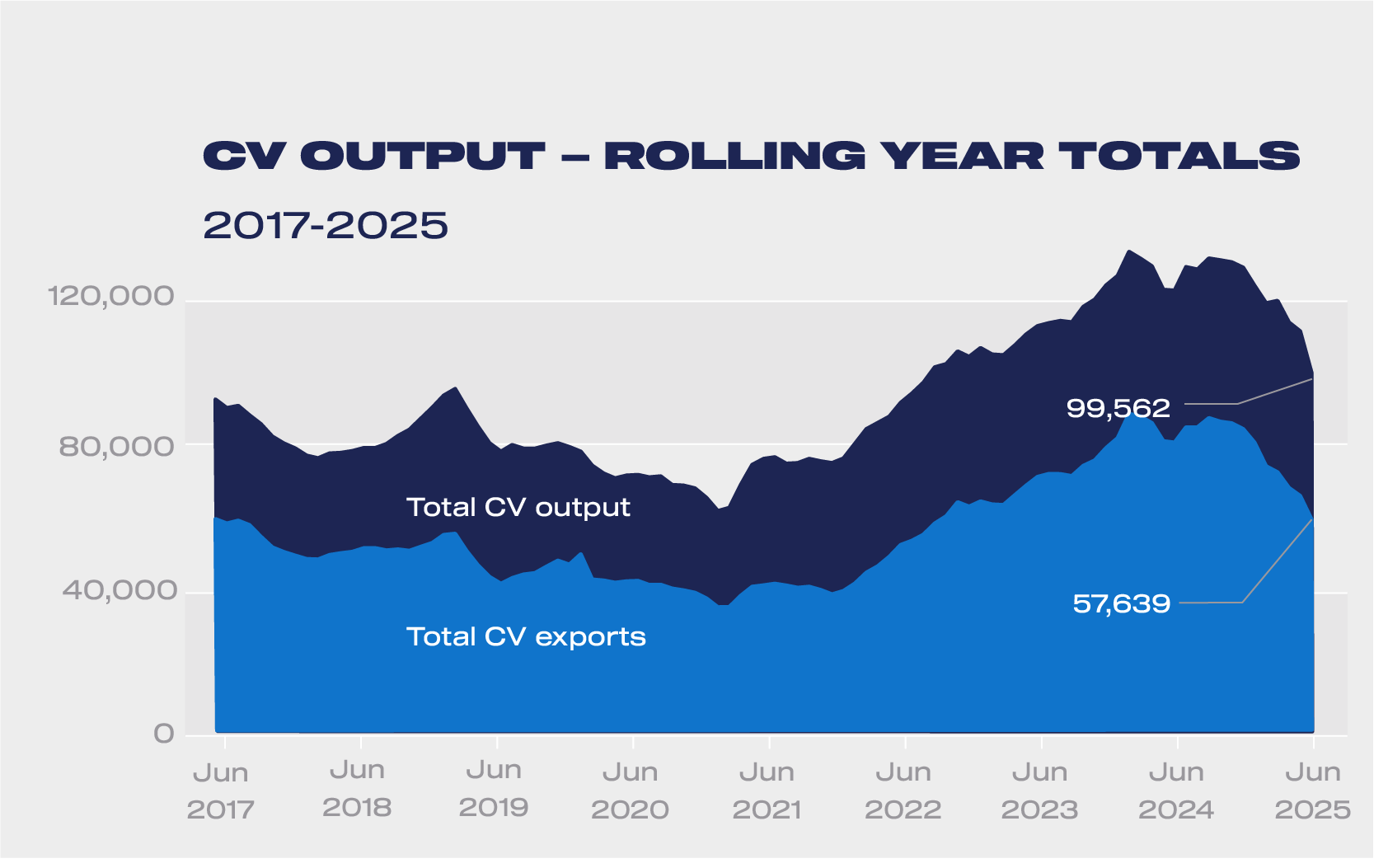

UK car production rose for the second consecutive month in July, up 5.6% to 69,127 units, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). Commercial vehicle (CV) output, however, fell -81.1%, reflecting plant restructuring and a bumper month last year, when the sector recorded the best July in 17 years which, when combined, dragged total vehicle production down -10.8% to 72,006 units.1

Car production for domestic and export markets improved, rising 13.6% and 3.7% respectively with overseas markets taking by far the majority (79.4%) of output. The EU remained the main destination for UK car exports (45.6% share), followed by the US (18.1%) China (7.7%), Turkey (7.2%) and Japan (3.4%). While shipments to the EU and China fell by -7.9% and -7.1% respectively, output for Turkey and Japan grew 35.4% and 14.9%. Exports to the US, meanwhile, rose by 6.8% to almost 10,000 units, reversing three straight months of decline.

The US remains the largest single national market for British built cars, underscoring the importance of the UK-US trade deal, and July’s performance illustrates the impact of this deal which came into force on 30 June. Australia, Canada, Korea, the UAE and Switzerland rounded off the top 10 export markets, although combined they represented just 6% of all shipments in the month.

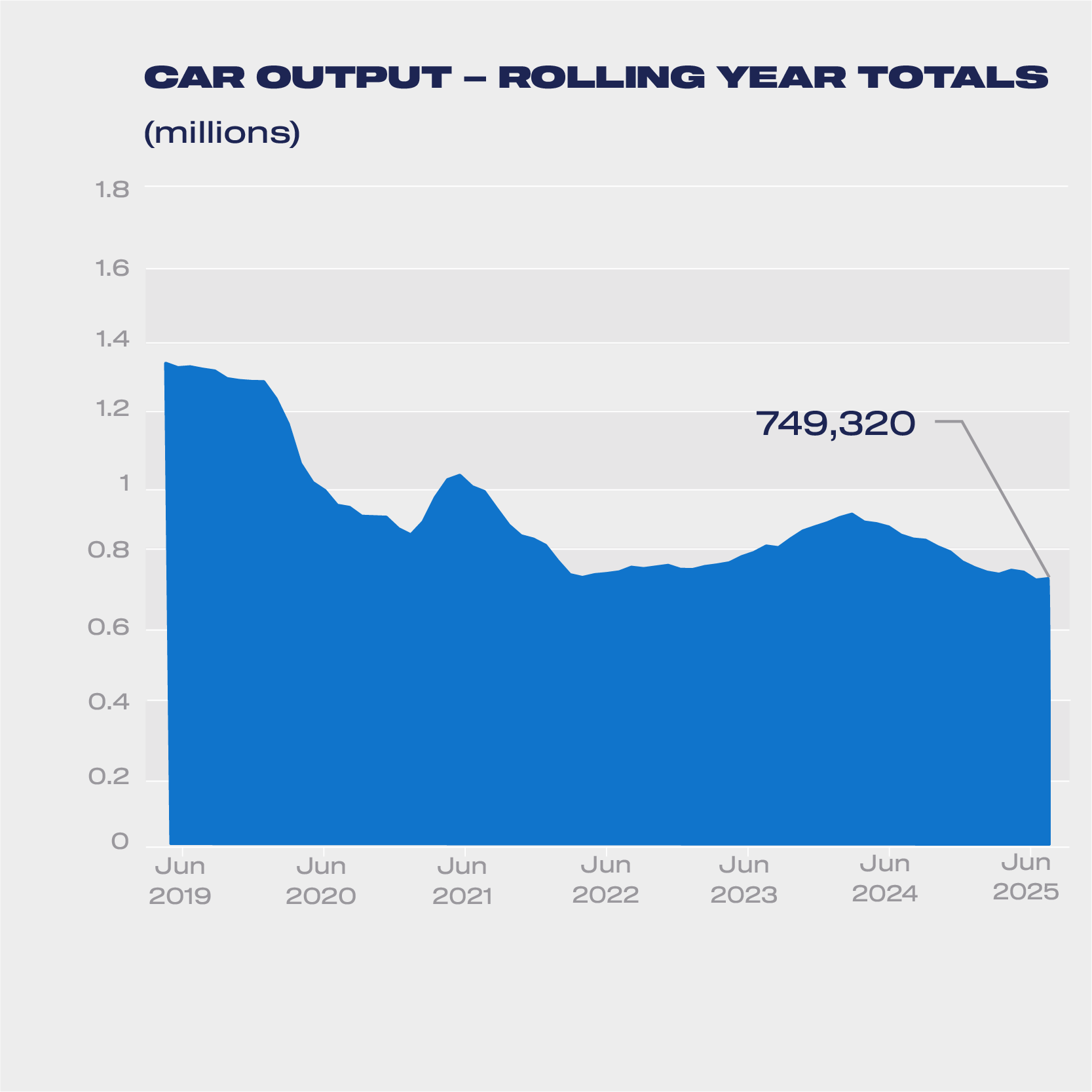

In the year to date, total vehicle output is down -11.7% with just shy of half a million units (489,238) produced. However, the latest independent production outlook for light vehicles anticipates growth to return in 2026, with output expected to rise 6.4% to 803,000 units. Rapid implementation of the new Industrial Strategy – including the dedicated automotive sector programme DRIVE35 – plus measures to reduce energy costs, accelerate infrastructure rollout and address skills gaps should help improve the UK’s competitiveness and ability to attract investment.

Mike Hawes, SMMT Chief Executive

It remains a turbulent time for automotive manufacturing, with consumer confidence weak, trade flows volatile and massive investment in new technologies underway both here and abroad. Given this backdrop, another month of growing car output is good news – signalling the sector’s underlying resilience in the face of intense global competition. To unlock sustained growth, however, government strategies must become tangible actions as a thriving automotive sector can support well paid jobs and economic development across the UK.

Notes to editors

The next release will be published on Thursday, 25 September 2025

- 1: 15,252 CVs turned out in July 2024

SMMT Update

Sign up

SMMT Update

Sign up to the SMMT Update Newsletter for weekly automotive news and data

"*" indicates required fields

The post Car production recovery continues in July appeared first on SMMT.

]]>The post UK vehicle production falls but foundations set for recovery appeared first on SMMT.

]]>File download

UK New Vehicle Manufacturing June 2025

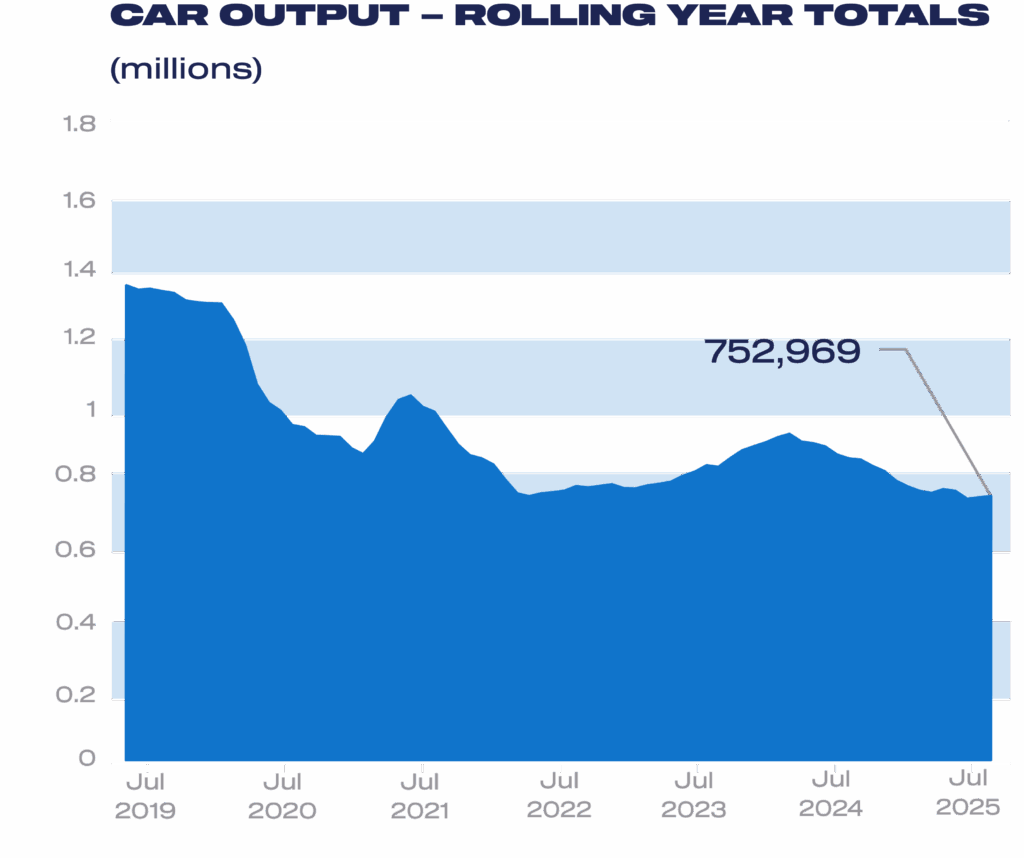

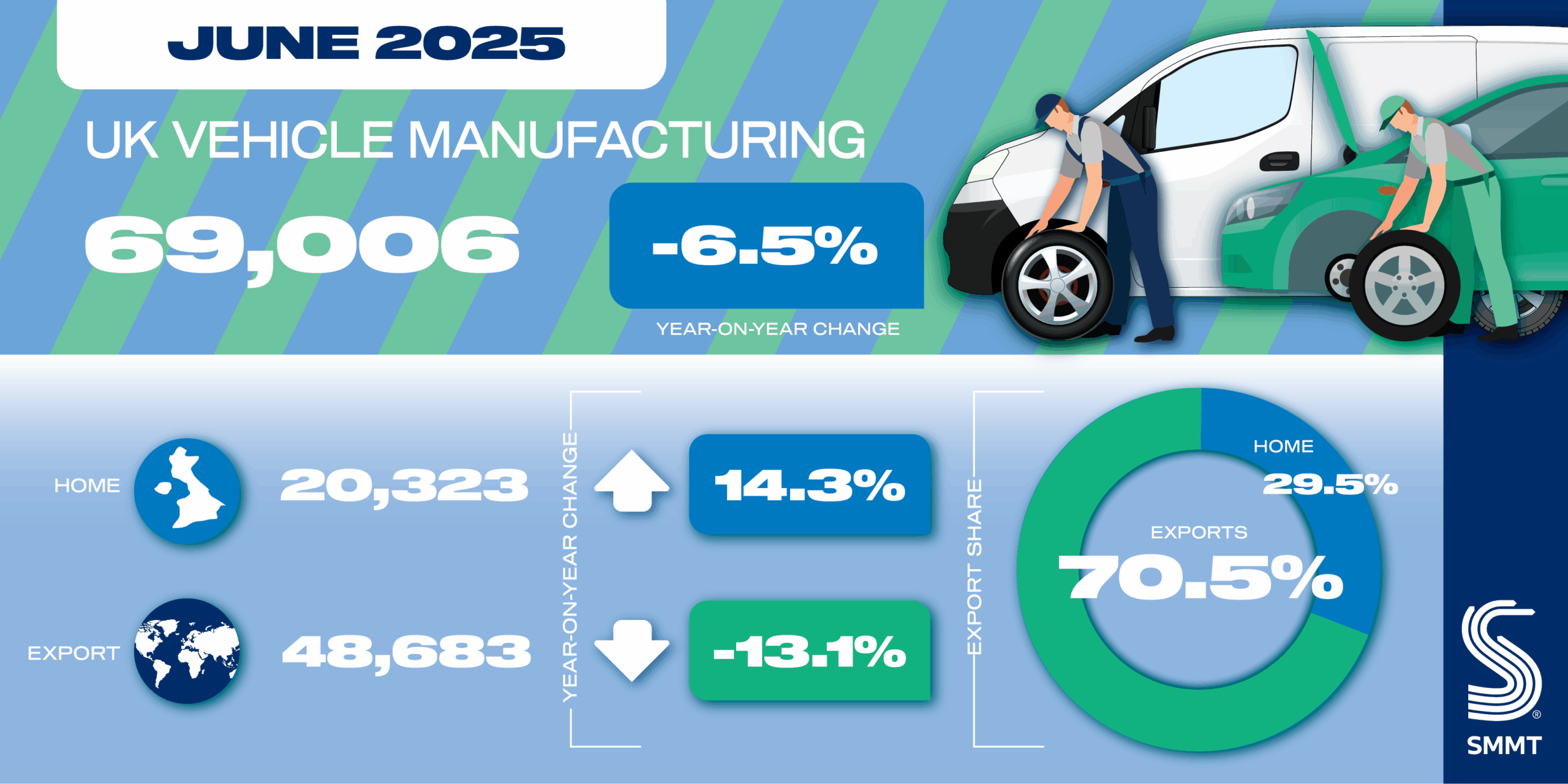

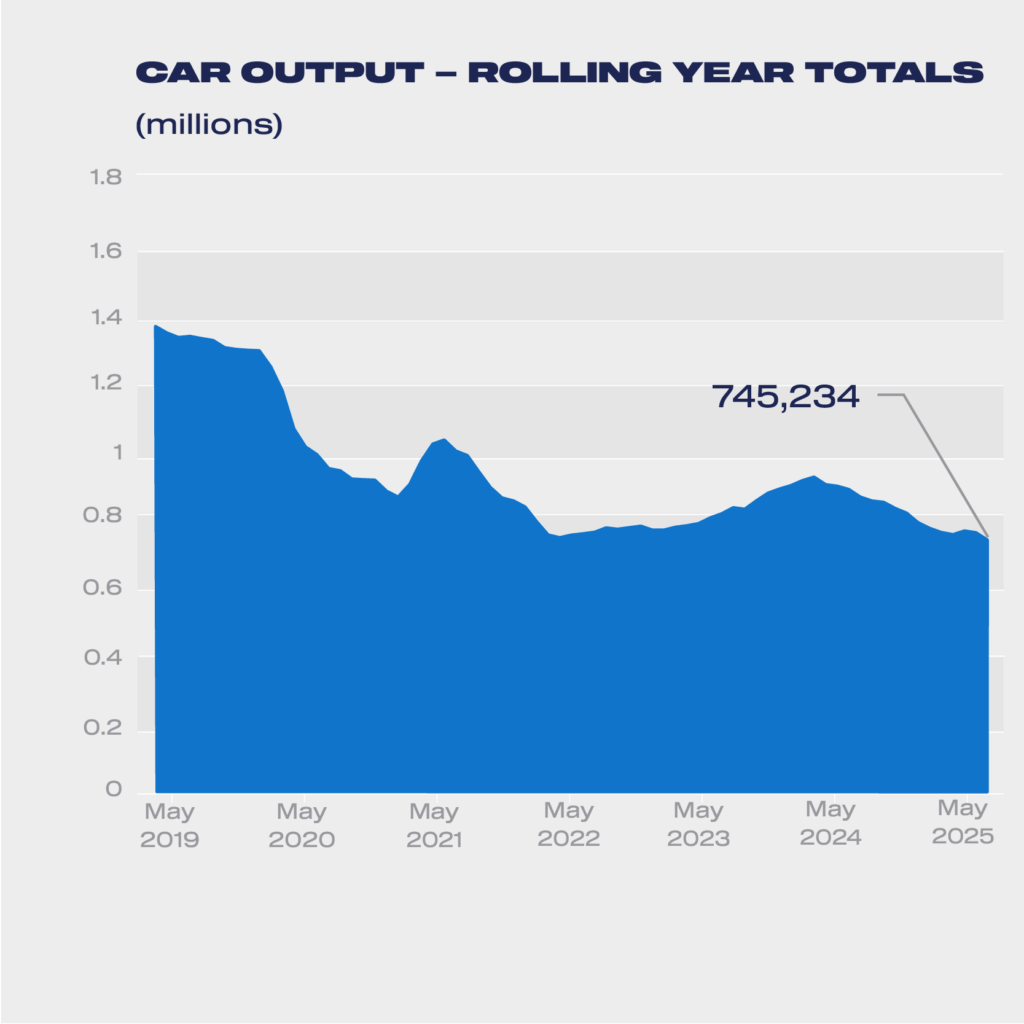

UK new vehicle manufacturing declined by -11.9% to 417,232 units in the first six months of the year, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT).

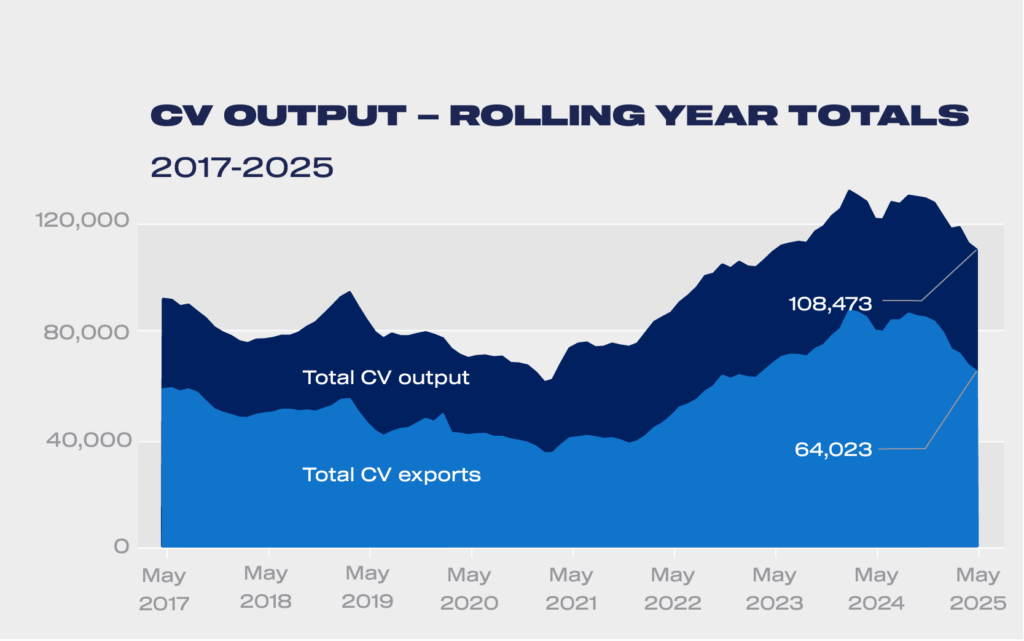

The decline was softened by a 6.6% increase in car production in June, although this was in comparison with last year when model changeovers and supply chain issues stymied output.1 As a result, year-to-date car output declined by -7.3% as 385,810 cars rolled off factory lines. Restructuring at commercial vehicle production plants, meanwhile, resulted in a first-half volume fall of -45.4% to 31,422 units.

While overall output fell, electrified car production rose by 1.8% to 160,107 units – delivering a record share of output for the first half of the year, with hybrid, plug-in hybrid and battery electric vehicles accounting for more than two in five (41.5%) units produced in the UK in 2025.

UK car production remains export-focused, with 76.9% of output headed overseas year-to-date and greater certainty now returning to key markets. The EU remains the main destination for UK car exports (54.4% share), followed by the US (15.9%) China (7.5%), Turkey (4.1%) and Japan (2.7%), with these five destinations alone accounting for more than eight in 10 overseas sales. Despite three straight months of declining export volumes culminating in an -18.7% drop in June, the US maintained its position as the UK’s biggest single export market underscoring the importance of the UK-US trade deal. That deal, which came into force on 30 June, gives the UK reduced tariff rates into the US automotive market, which can become a basis for future growth.

With the global economy continuing to be buffeted by economic and trade uncertainty, the latest independent production outlook anticipates total 2025 vehicle output will fall by -15% to 755,000 units in 2025, but an expected 6.4% increase next year would take total production to 803,000 units.

Rapid implementation of the new Industrial Strategy, however, with wider measures to reduce energy costs, accelerate infrastructure, and address skills gaps, could restore the UK’s competitive edge, returning Britain to a top 15 global auto manufacturing location and providing an additional £50 billion economic windfall. The government’s automotive sector strategy, DRIVE35, also sets out a package of measures which will support the sector and its economic and environmental ambitions. Furthermore, with the announcement of the Electric Car Grant, which provides £650 million of fiscal incentives for EVs, there is the potential to energise the domestic market that underpins the UK’s attractiveness as an industrial investment opportunity.

Mike Hawes, SMMT Chief Executive

Global economic uncertainty and trade protectionism have taken their toll on automotive production across the globe, with the UK no exception. The figures are not, therefore, unexpected but remain very disappointing. However, there are foundations for a return to growth.

The industry is moving to the technologies that will be the future of mobility, our engineering excellence, highly-skilled workforce and global reputation are strengths, and we have an Industrial Strategy with advanced manufacturing and automotive at its core. With rapid delivery and the right conditions, UK Automotive can reverse the current decline and deliver the jobs, economic growth and decarbonisation that Britain needs.

Notes to editors

- UK car production June 2024: 62,231 units, down -26.6%

SMMT Update

Sign up

SMMT Update

Sign up to the SMMT Update Newsletter for weekly automotive news and data

"*" indicates required fields

The post UK vehicle production falls but foundations set for recovery appeared first on SMMT.

]]>The post UK vehicle production constraints continue in May appeared first on SMMT.

]]>File download

UK New Vehicle Manufacturing May 2025

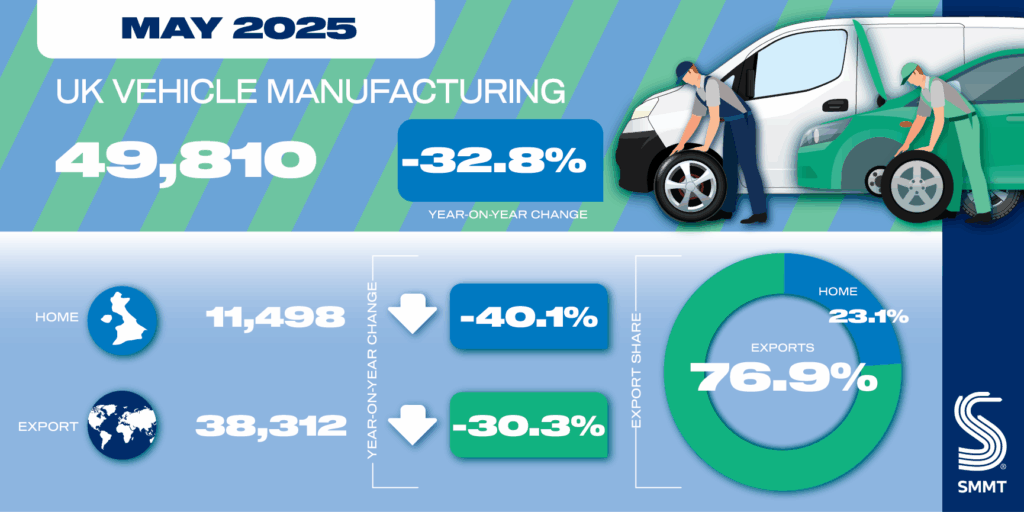

UK car and commercial vehicle production fell for the fifth consecutive month in May, down -32.8% to 49,810 units, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). Excluding 2020, when Covid lockdowns saw factories shuttered or running at greatly reduced capacity, it was the lowest performance for the month since 1949.1 Year to date, total output is down -12.9% on 2024, to 348,226, the lowest since 1953.2

Car production declined -31.5% in the month, due primarily to ongoing model changeovers, restructuring and the impact of US tariffs, with 47,723 units rolling off factory lines. Commercial vehicle output was also down sharply, by -53.6% to 2,087 units, as the closure of one of the UK’s CV plants continues to impact comparisons with last year.

Car production for export fell by -27.8%, although a -42.1% fall in output for the smaller domestic market meant exports comprised a larger share of production, up to 78.5%. Shipments to the EU and US, the UK’s two largest markets, fell by -22.5% and -55.4% respectively with the US share of exports declining from 18.2% to 11.3%. This was primarily due to the imposition by the US administration of a supplementary 25% Section 232 tariffs on cars from March which depressed demand instantly forcing many manufacturers to stop shipments. However, with the trade agreement negotiated by government due to come into effect before the end of June, this should hopefully be a short-lived constraint. Declines were also recorded in exports to China and Turkey, down -11.5% and -51.0% respectively.

Export volumes of vans, buses, coaches, taxis and trucks also declined in May, down by -71.7% year on year. The EU remained overwhelmingly the sector’s biggest customer, accounting for 94.7% of exports, although volumes fell -72.1%. As a result, the export share of overall commercial vehicle production fell from 67.9% to 41.4%, with the domestic market now the primary destination for UK commercial vehicle output.3

While overall vehicle output is currently constrained, with the right competitive conditions in place, automotive manufacturing can deliver significant gains for UK jobs, the economy and decarbonisation. With three major new trade deals secured with the US, EU and India, the sector has pledged to build on the government’s landmark Industrial and Trade Strategies published this week. Rapid action on energy costs and an increased ability to access key overseas markets – plus additional measures to energise domestic demand – could put the UK on course to reclaim its place in the top 15 automotive manufacturing nations, for the first time since 2018.4

Mike Hawes, SMMT Chief Executive

While 2025 has proved to be an incredibly challenging year for UK automotive production, there is the beginnings of some optimism for the future. Confirmed trade deals with crucial markets, especially the US and a more positive relationship with the EU, as well as government strategies on industry and trade that recognise the critical role the sector plays in driving economic growth, should help recovery.

With rapid implementation, particularly on the energy costs constraining our competitiveness, the UK can deliver the jobs, growth and decarbonisation that is desperately needed.

Notes to editors

- May 1949: 49,287 units

- Jan-May 1953: 318,306 units

- Domestic share of CV production has been below 50% for one quarter, since March 2025

- Industrial Strategy can be springboard for UK auto success, 24 June 2025

SMMT Update

Sign up

SMMT Update

Sign up to the SMMT Update Newsletter for weekly automotive news and data

"*" indicates required fields

The post UK vehicle production constraints continue in May appeared first on SMMT.

]]>The post SMMT response to Government’s Trade Strategy appeared first on SMMT.

]]>UK Automotive is a trade powerhouse, generating imports and exports worth £108 billion a year and typically Britain’s biggest exporter of manufactured goods. Free and fair trade is fundamental to our success and recent agreements with India, the US and, particularly, the EU signal that intention.

Today’s trade strategy, aligned to the industrial strategy announced earlier this week, provides confidence to help our sector navigate the many headwinds we face and sets a foundation for future success. Balanced trading relationships that break down tariffs and regulatory barriers to trade will enable automotive companies to grow and get great British products into the hands of consumers all over the world, boosting jobs, business and prosperity at home.

The post SMMT response to Government’s Trade Strategy appeared first on SMMT.

]]>The post Industrial Strategy can be springboard for UK auto success appeared first on SMMT.

]]>The UK automotive industry has pledged to build on the foundations laid by government’s landmark Industrial Strategy – published yesterday – with a 10-point plan to propel the UK back into the top 15 of global vehicle manufacturing locations by 2030 and deliver a £50 billion economic boost over the next decade.1

Speaking at the industry’s annual Summit in London today, Mike Hawes, Chief Executive of the Society of Motor Manufacturers and Traders (SMMT), welcomed the news saying, “Government’s long-term Industrial Strategy, including the Drive35 £2.5 billion auto capital and R&D fund, recognises automotive as a pillar of advanced manufacturing, integral to the world leading innovation that creates the high value jobs, wealth and economic growth that are vital to our country’s future. Now we must make the most of that position and put in place the right conditions for growth.”

The strategy comes as a new SMMT report, The Competitive Edge: Driving Long-Term UK Automotive Growth, sets out a path to success. The report, which features SMMT’s first UK Automotive Business Leaders Barometer, charts the industry’s fundamental strengths and potential, with more than half of businesses having recently secured, or planning for, investment. But it also reveals, unsurprisingly, low confidence in global trading conditions and doubts about the ability to meet net zero ambitions, amid rising costs and falling profitability.

Almost three quarters (73.5%) of the CEOs surveyed said their business costs had increased in the last year, with 46.9% reporting falling profits.2 The sector also faces some of the world’s toughest market regulation and compliance costs – factors which must be addressed urgently to create a level playing field that anchors existing investors and creates the right conditions for further growth.

UK automotive manufacturers pay more for electricity than anywhere else in Europe – more than double the average – due in part to energy taxes six times higher, which added over £200 million to manufacturers’ bills last year alone.3 Rapid implementation of the reforms to industrial energy costs set out in the Industrial Strategy would cut the sector’s electricity bill by a fifth, helping ease this structural disadvantage. To level the playing field, however, the proposed relief on standing charges – which will apply to battery manufacturing – should also benefit automotive manufacturing, given the sector will become more electricity-dependent as it increasingly builds EVs.

Current uncompetitive production costs must also be set alongside uncompetitive market costs. Manufacturers have incurred a £6.5 billion electric vehicle incentives bill over the last 18 months to shore up EV demand that remains stubbornly behind mandated government targets – with more than half (52%) of CEOs believing the UK is significantly behind track to meet the 2030 end of sale date for new cars powered solely by combustion engines.4 Consumer demand has been further damaged by governmental disincentives such as the VED Expensive Car Supplement (ECS), estimated to impose an effective fine of more than £360 million on EVs bought from April this year.5

Bold government action to drive up demand for the electric vehicles which manufacturers are compelled to sell is essential, requiring a package of consumer support measures, including amendments to the ECS and cuts to VAT on new EVs and public charging. This would help deliver a vibrant domestic market which is not just a leader in decarbonisation but in affordability.

There is room for optimism, however, as recent UK diplomatic successes – the deal with the US, which significantly reduces a tariff cost that would have threatened industry viability, as well as the FTA with India and an EU reset – will undoubtedly help put the UK in a more advantageous position. Together with rapid measures to reduce electricity costs and business rates, reformed capital allowances and a reskilled workforce, the sector’s competitive edge would be restored, providing an additional £50 billion economic windfall and delivering the UK’s net zero ambitions, while returning the UK to the top 15 of global auto manufacturing locations for the first time since 2018.

We welcome the Government’s Industrial Strategy, a 10-year plan which answers our call for a long-term commitment to automotive manufacturing. With action to reduce electricity costs, upskill workers and unlock finance, it lays the foundation on which we can build our future. We now need to see the Strategy implemented and at pace, because competitors will move fast so our window of opportunity will not remain open for long. The prize, however, in terms of jobs, innovation and economic growth – green growth at that – is worth the investment.

Mike Hawes, SMMT Chief Executive

The Competitive Edge: Driving Long-Term UK Automotive Growth sets a joint challenge to return the UK to the Top 15 global automotive manufacturing locations by 2030 with 10 recommendations to deliver as part of an Industrial Strategy, as follows:

- Introduce transformative new support to supercharge the market, including a major purchase incentive scheme for consumers for the duration of the mandate, and maintenance and extension of support for harder to decarbonise segments.

- Publish a clear roadmap for bus, coach and heavy-duty vehicle decarbonisation co-developed with industry.

- Ensure everyone has a ‘right to charge’ by mandating delivery of public charging and refuelling infrastructure across the UK.

- Ensure the UK’s competitiveness prospectus and role of the Office for Investment to promote the UK’s offer is geared to support new and existing investors.

- Reduce the cost of energy and support manufacturers to remain internationally competitive.

- Provide step-change supply chain funding to de-risk private investment into competitiveness building activities.

- Follow through on the promise to allow 50% of the apprenticeship levy to be spent on non-apprentice training.

- Maximise and develop the EU-UK economic relationship to protect and grow the European automotive sector.

- Deliver on the foundations of the UK-US Economic Prosperity Deal to maximise automotive exports.

- Secure trade agreements with new and existing trading partners which place automotive at their core.

Notes to Editors

1: SMMT analysis in The Competitive Edge: Driving Long-Term UK Automotive Growth

2: SMMT analysis – UK Automotive Business Leaders Barometer 2025 – a survey of CEOs and MDs undertaken between April and May 2025, with more than 50 respondents representing businesses with a combined £79 billion turnover and 87,000-strong workforce – representing 98% of UK vehicle production. 35% of respondents were vehicle manufacturers, 40% supply chain businesses and 25% other auto companies.

3: SMMT Sustainability Report 2024.

4: Based on AutoTrader data on EV discounts, JATO sales weighted recommended retail price data and SMMT EV market data and own-estimates of fleet discounts.

5: SMMT analysis.

The post Industrial Strategy can be springboard for UK auto success appeared first on SMMT.

]]>The post Competitive Edge: Driving Long-Term UK Automotive Growth appeared first on SMMT.

]]>The UK’s new Modern Industrial Strategy is a watershed moment that comes at a time of considerable global uncertainty.

Our ambition to transition to zero emission mobility, one that is shared with government, will see car and van increasingly decarbonised to 2035 and HGVs thereafter. But the path to that ambition is paved with obstacles. Tariffs and trade protectionism have fundamentally altered the global trading environment, economic uncertainty stifles growth and consumer affordability, and thus demand is constrained.

However, UK Automotive’s role as a key driver of net zero and economic success remains certain. Our sector directly contributes more than £25 billion in value to the economy and more than £44 billion worth of exports annually, while employing nearly 800,000 people. We inspire innovation, with 23 R&D and nine design centres, mastering the technologies of the future. And we are driving the zero emission transition, having put more than a million zero emission vehicles on the road in the past five years despite a reticent market.

Furthermore, the wider halo effect of automotive – supporting the nation’s advanced manufacturing capabilities and engineering skills – cannot be understated.

Confidence is returning. Our automotive business leaders survey shows that half of all businesses surveyed have secured or are seeking new investment in the UK, despite a globally volatile and economically challenging environment.

We must, therefore, re-create a competitive edge that delivers growth, employment and the critical capabilities that will shape the next generation of mobility. Government has taken several positive steps in the last 12 months, but the time now is for giant leaps.

The return to a long-term Industrial Strategy, with automotive rightly recognised within the government’s eight growth-leading sectors, is significant. Automotive sits at the core of the Advanced Manufacturing Sector Plan but now needs rapid action to close the gap with international competitors.

Energy cost relief is the headline-grabbing measure and its delivery will be the acid test of the Strategy. Government has already made minor reforms to the Zero Emission Vehicle Mandate to help manufacturers meet the requirements and we must assess the market closely, as consumer demand remains low without incentives. And critical trade agreements with the United States and India, and a reinvigorated relationship with the European Union, offer new hope on the global stage for our export-led manufacturers who want to grow at home and abroad.

The new Industrial Strategy must be the foundation on which the growth of UK automotive is built. We want to return the UK to the top 15 global auto manufacturing locations and deliver a £50 billion boost to our nation’s economy. With the right enablers in place, this can be a reality given our capabilities, our heritage, our innovation and our people.

The new industrial strategy – and the forthcoming trade strategy – must be implemented in full and at pace. They are purposefully and rightly long term. They must be supported across government and they must build confidence, enhance investor relations, and create the conditions for us to compete. Do this, and the automotive sector will repay that investment in full, delivering the economic, social and environmental benefits the UK deserves.

The post Competitive Edge: Driving Long-Term UK Automotive Growth appeared first on SMMT.

]]>The post SMMT response to Government’s Industrial Strategy appeared first on SMMT.

]]>

“The publication of an Industrial Strategy – one with automotive at its heart – is the policy framework the sector has long-sought and Government has now addressed. Such a strategy – long-term, aligned to a trade strategy and supported by all of Government – is the basis on which the UK automotive sector can regain its global competitiveness. Making the UK the best place to invest now depends on implementation, and implementation at pace, because investment decisions are being made now against a backdrop of fierce competition and geopolitical uncertainty. The number one priority must be addressing the UK’s high cost of energy, enabling the sector to invest in the technologies, the products and the people that will give the UK its competitive edge.

The post SMMT response to Government’s Industrial Strategy appeared first on SMMT.

]]>The post SMMT response to Comprehensive Spending Review appeared first on SMMT.

]]>The automotive industry recognises the pressure on the public purse and the need to divert funding to defence and growth. Automotive can deliver that growth but it depends on both competitive conditions and consumer confidence.

Some support for EVs has been made available, but more substantive measures to incentivise private consumer demand are still needed if world leading targets are to be met.

Government has already made great efforts to support a critical industry facing significant geopolitical challenges but without market-making interventions, that world-leading pace of transition may need to be reviewed.

The post SMMT response to Comprehensive Spending Review appeared first on SMMT.

]]>